Marketmind: Transitory faith in transitory inflation

A look at the day ahead from Julien Ponthus.

Say your economy is growing at about 5% annually, it just hit a 10-year inflation high of 3% read more amid labour shortages and enjoys negative yields on benchmark government bonds .

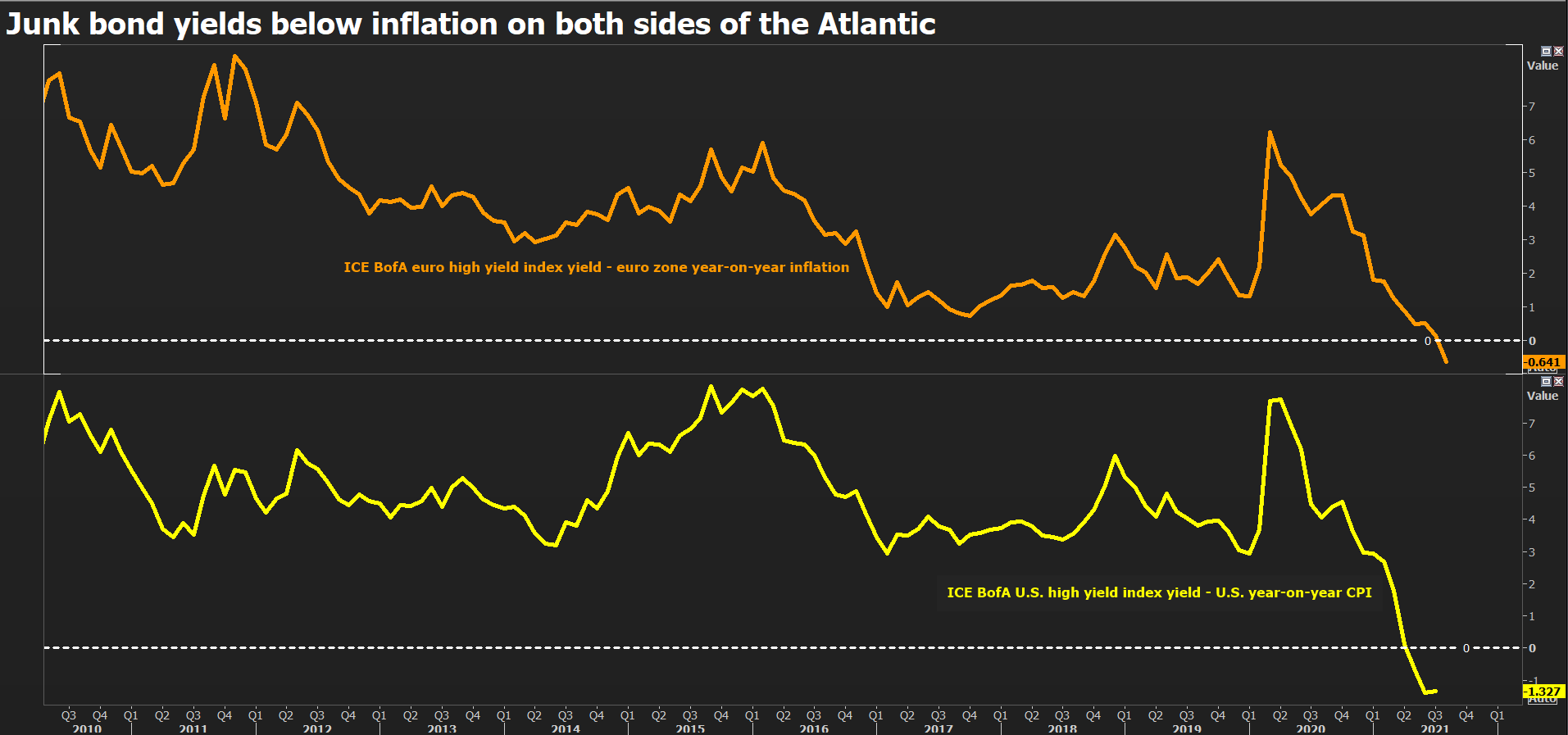

Let’s add that junk-rated bonds have fallen below the economy’s inflation rate.

Does this economy really need more quantitative easing?

‘Yes’ will be the answer from Christine Lagarde and other European Central Bank policymakers when they meet on Thursday. The unknown quantity is whether the pace of bond buying should be slowed. read more

For its defence, the ECB argues that one-off factors related to economies reopening from COVID-19 lockdowns are driving the bulk of the inflation surge, and that price growth will moderate early next year.

The transitory inflation narrative has so far managed to soothe investors’ nerves but with expectations of inflation reaching 5% in Germany this year, the concerns of the ECB hawks read more might be increasingly hard to dismiss.

Markets’ faith in transitory inflation seems to be waning meanwhile, with German government borrowing costs hitting their highest level since mid-July on Friday after data showed robust business activity in the euro zone. read more

U.S. Treasury yields also rose on Friday after data showed fewer new jobs created in August but a sharp increase in wages and a continued drop in unemployment.

Yet stimulus, be it fiscal or monetary, will remain the name of the game for a while yet.

That belief and talk of more stimulus in Japan and China has lifted Asian shares to six-week peaks, European stocks are in striking distance of their August record highs, albeit in thin volumes given a U.S. public holiday.

Key developments that should provide more direction to markets on Monday:

–Aluminium prices hit the highest in more than 10 years due to political turmoil in bauxite mining hub Guinea

–Porsche (PSHG_p.DE) and Puma (PUMG.DE) among companies joining Germany’s DAX stock index, as it expands to 40 from 30 constituents read more .

— G20 health ministers summit ends in Rome

— German industrial orders surged in July to a post-reunification high read more

-Goldman Sachs unit Petershill Partners plans to raise at least $750 million in London listing read more

— UK new vehicles Aug

— European banks still booking profits in tax havens, says report read more

Reporting by Julien Ponthus; editing by Sujata Rao

Our Standards: The Thomson Reuters Trust Principles.

Source: https://www.reuters.com/business/morning-bid-transitory-faith-transitory-inflation-2021-09-06/