Latin America and the Caribbean after Covid-19

Latin America and the Caribbean suffered from several regional preconditions in advance of the Covid-19 crisis, including weak health infrastructure, low growth, and inefficient taxation. Now the pandemic threatens to leave the region with even higher poverty levels, greater inequality, and debts across virtually all countries. This column recognises the severity of these challenges but also provides reason to hope. If Covid-19 produces the political will to move the region towards better policy frameworks and execution, something positive could come of the crisis.

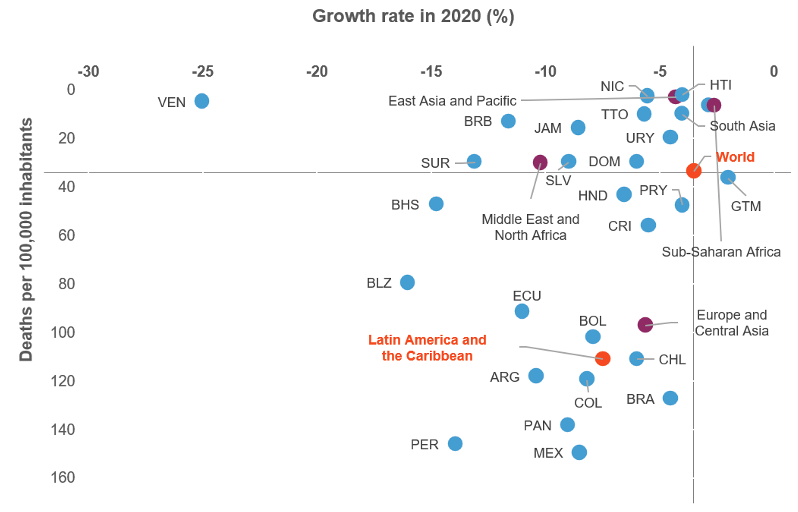

There appears to be no real trade-off between growth rates in 2020 and deaths due to Covid-19 in the same year. Countries that suffered more deaths tended to have lower growth and vice versa (see Figure 1). Unfortunately, many countries in Latin America and the Caribbean are located in the wrong sector of the graph. The region has only 8% of the global population but accounts for more than 25% of deaths and lost an estimated 7.0% of GDP, the largest loss in a single year since the struggle for independence 200 years ago.1

Figure 1 2020 growth rates and Covid-19 deaths

Source: Cavallo and Powell (2021)

Tourism-dependent countries such as the Bahamas, Barbados, and Jamaica suffered deeper falls in GDP than might have been anticipated given the level of deaths (they would be located above a naïve regression line), while Brazil and Chile suffered more deaths than could have been expected given the depth of the recessions. The crisis is threatening to leave the region with higher poverty levels, greater inequality, and higher debts across virtually all countries.

There are many potential reasons why the region fared poorly. Weak health infrastructure, patchy enforcement of lockdowns, high levels of informality, and a lack of connectivity to work from home may have worsened the health crisis (Busso and Messina 2020). Meanwhile, limited fiscal packages and central bank assistance may have caused more suffering to the region’s economies. The average fiscal package was about 8.5% of GDP, but that figure includes a few large packages (e.g. in Brazil, Chile, and Peru) and more than a third of countries implemented fiscal packages comprising 3% of GDP or less. In contrast, advanced economies put together fiscal packages of about 19% of GDP on average.

Given the experiences in the 1980s, central banks in Latin America and the Caribbean tend to have tight legal restrictions on asset purchasing. So, while many central banks reduced interest rates and reserve requirements, their balance sheets expanded less than their counterparts in advanced economies. Again, the central banks in Brazil, Chile, and Peru were the most active according to this measure, acquiring assets from banks and governments, boosting reserves, and expanding base money and short-term sterilisation liabilities.

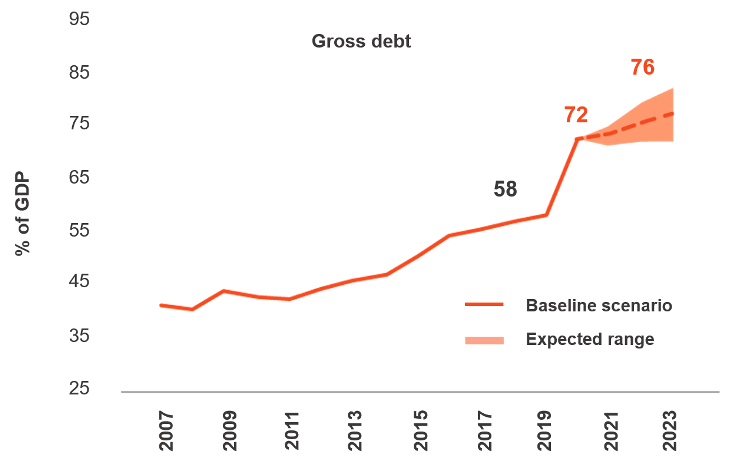

Still, given higher public spending and lower revenues, overall fiscal deficits rose from about 3% of GDP in 2019 to 8.3% of GDP in 2020, and public debt rose from 58% of GDP in 2019 to 72% of GDP in 2020. Simulations presented in the 2021 Latin American and Caribbean Macroeconomic Report (Cavallo and Powell 2021) suggest debt-to-GDP ratios will continue to rise to about 76% of GDP by 2023, but there is considerable uncertainty regarding any projections.

Figure 2 Scenarios for gross debt in Latin America and the Caribbean

Source: Cavallo and Powell (2021)

Economic activity has started to bounce back, but how fast and sustainable this recovery will be depends on winning the war against the virus. IMF projections put the region on track to grow 4.6% in 2021, with a gradual return to trend growth of about 2.5% per year thereafter. But if vaccine rollouts are delayed or more contagious strains prove to be vaccine resistant, new lockdowns could result in a double-dip or W-shaped recovery.2

There are also some positive developments. China grew in 2020, helping to support commodity prices, and private forecasts suggest growth could be in excess of 8% this year. Growth projections have been boosted in the US given the additional $1.9 trillion stimulus and further potential infrastructure investment.

Still, longer-term interest rates have already started to rise and there is concern that the Federal Reserve may be forced to alter its patient stance on policy interest rates. Market participants appear divided on the likelihood and severity of a temper tantrum à la 2013, or worse (for contrasting views, see de la Merced 2021 and Whiteley 2021).

Further simulations suggest growth in Latin America and the Caribbean could be as high as 5.6% in 2021 if there is stronger world growth and only a mild market correction. But a serious tantrum could wipe out any gains, bringing growth rates for the region back to the baseline.

In this context, Latin American and Caribbean governments are attempting to navigate a path providing relief to families and firms while maintaining fiscal sustainability. Finding the right fiscal strategy will be key and will depend on domestic characteristics. In South America, tax revenues and public spending levels tend to be high. Seeking greater efficiency in both spending and tax systems could bring very significant rewards. Inter-American Development Bank (IDB) estimates suggest the region could save 4.4% of GDP on average (and even more in some countries) by improving the targeting of social transfers, reducing fuel subsidies, and curbing public wages where they are considerably higher than private sector comparators.

In Central America, countries tend to have limited tax takes and low spending as a proportion of GDP. If a reasonable level of efficacy can be guaranteed, there could be significant benefits to increasing future tax revenues and boosting well-targeted spending as recovery takes hold. In the Caribbean, there are many opportunities to improve spending efficiency by simplifying and eliminating tax breaks and improving tax structures.

The timing of fiscal consolidation after the crisis will have to be managed very carefully. If it is too fast, recovery may stall. If it is too slow, debt sustainability may be put at risk. Improving fiscal institutions would provide immediate benefits. Greater credibility would allow for a more gradual adjustment with lower interest rates, which would reduce the potential risks of consolidation.

With the crisis also come opportunities. Multinational companies have been rethinking their supply chains. The US switched over $50 billion of imports of intermediate goods to new suppliers. This represents an enormous opportunity as the region only exports about $26 billion in intermediate goods to its northern neighbour. Still, many firms find it difficult to participate in global value chains on a consistent basis. Unfortunately, the most recent data does not show that the region has taken advantage of these changes to date. Improving the work of export agencies – as well as logistics, trade infrastructure, and trade finance – could help.

Boosting regional value chains could allow firms in the region to become more competitive internationally. But the ‘spaghetti bowl’ of regional trade agreements has many inconsistencies that prevent regional supply chains from developing. A bottom-up approach to ensure consistency (such as allowing rules of origin to cumulate) could lead to increases in regional trade and more globally competitive firms.

The crisis particularly hurt labour-intensive sectors in which social distancing was hard. Evidence from previous crises shows that these sectors are likely to bounce back as the health crisis fades. But these sectors also have the lowest levels of productivity, so the crisis provides an opportunity to build back more productively. With the right policies to promote formality and allow successful firms to grow, these sectors could be transformed.

There is an urgent need to boost the amount and the efficiency of infrastructure investment. This could be financed either through the public sector, by taking advantage of fiscal savings, or through financing from private sources. Well-chosen projects benefit low-income families, promoting inclusive growth. Infrastructure also has spill-over effects across other sectors. And the right projects can boost productivity in sectors as they recover (Cavallo et al. 2020). Each peso of investment in infrastructure adds about two pesos to GDP. Because efficiency in infrastructure investment itself leaves a lot to be desired, improvements could lead to even higher multipliers.

Finally, the region is still facing another challenge that has not disappeared: the climate crisis. Here there is some good news. Technology has advanced to the extent that in several areas, such as energy and transport, climate and growth objectives could be achieved together. Adopting ambitious climate goals can be growth-enhancing. By expanding renewable electricity capacity and electricity grids, increasing electrical mobility, boosting mass transit, and improving energy efficiency in the residential, commercial, and industrial sectors, countries of the region can create millions of jobs and add about 1.3 percentage points of incremental growth per year.

Latin America and the Caribbean suffered from several preconditions before the Covid crisis erupted, from low growth to inefficient taxation and spending. Pre-crisis gains in reducing inequality had already stagnated, promoting social unrest. Different reports on the region from the main international organisations suggest there is considerable agreement on what needs to be done. Drazen and Grilli (1993), among others, have claimed crises have a way of stimulating reforms. If Covid-19 produces the political will to move towards better policy frameworks and execution, something positive may come out of this crisis.

References

Busso, M and J Messina (2020), “The Inequality Crisis: Latin America and the Caribbean at the Crossroads”, Washington, DC: Inter-American Development Bank.

Cavallo, E A and A Powell (2021), Opportunities for Stronger and Sustainable Postpandemic Growth, 2021 Latin America and the Caribbean Macroeconomic Report, Washington, DC: Inter-American Development Bank.

Cavallo, E A, A Powell and T Serebrisky, eds. (2020), “From Structures to Services: The Path to Better Infrastructure in Latin America and the Caribbean”, Development in the Americas Series, Washington, DC: Inter-American Development Bank.

de la Merced, M J, L Hirsch, J Karaian, E Livni and A R Sorkin (2021), “Time for a Tantrum?”, The New York Times, 26 February.

Drazen, A and V Grilli (1993), “The Benefit of Crises for Economic Reforms“, The American Economic Review 83(3): 598–607.

Neumeyer, P A, P Restrepo-Echevarría and L Belmudes (2020), “The COVID-19 Recession in Historical Perspective”, St. Louis Fed on the Economy Blog, 12 November.

Whiteley, G (2021), “Expect a taming of the bond market tantrum”, Financial Times, 15 March.

Endnotes

1 This statement is based on a series developed from the Maddison Project, although it should be noted that the data becomes increasingly sparse before 1890. See Neumeyer et al. (2020) for a more detailed account of how exceptional the Covid crisis has been in terms of GDP losses.

2 The 2021 Latin American and Caribbean Macroeconomic Report employs a G-VAR model to simulate alternative scenarios.