Shell pursues $7 billion buyback ‘at pace’ despite LNG troubles

LONDON, Jan 7 (Reuters) – Royal Dutch Shell said it will pursue “at pace” a $7 billion share buyback largely funded from the sale of its U.S. shale business as it faces liquefied natural gas (LNG) outages and slower fuel sales due to the economic hit from Omicron.

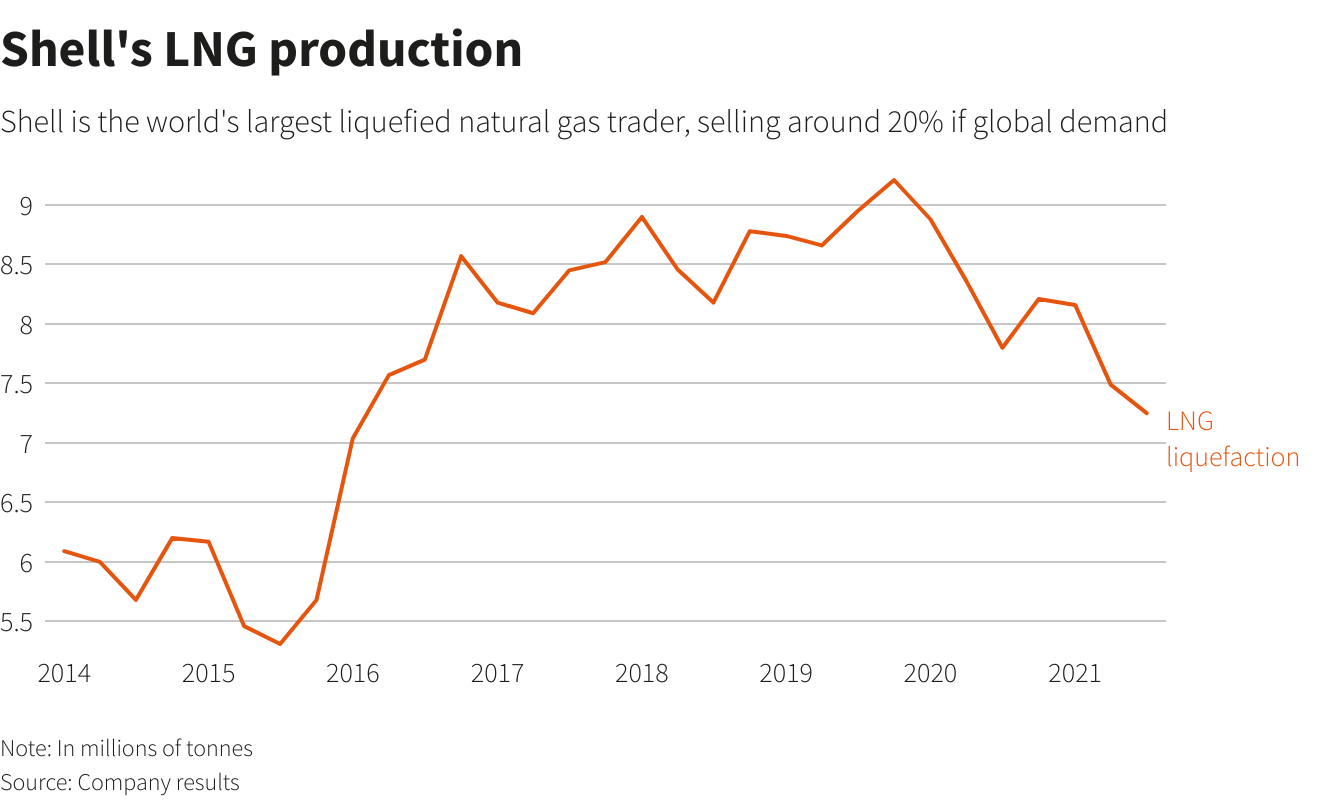

Shares in Shell (RDSa.L), the world’s largest trader of LNG, were down 0.32% on Friday after a trading update ahead of its quarterly results on Feb. 3. This compared with a 0.12% rise in the broader European energy index (.SXEP).

Shell said that its production and liquefaction volumes were impacted in the fourth quarter by unplanned maintenance, mainly in Australia, where its giant Prelude floating LNG vessel was hit by a power outage.

LNG liquefaction volumes are expected to be between 7.7 and 8.3 million tonnes, well below a peak of 9.2 million tonnes in the fourth quarter of 2019, Shell said.

Shell’s LNG trading results in the fourth quarter of 2021 are, however, set to be “significantly higher” compared to the third quarter.

Natural gas and electricity prices around the world have soared since the middle of last year on tight gas supplies and higher demand as economies rebounded from the COVID-19 pandemic.

Benchmark European gas prices and Asian LNG prices hit all-time highs in the fourth quarter.

Shell will later this month move its head office from The Hague to London, scrap its dual share structure and change its name to Shell Plc as part of a plan to simplify its structure and shift its tax residence from the Netherlands. read more

Last year Shell sold its Permian Basin shale oil assets to ConocoPhillips (COP.N) for $9.5 billion in cash, an exit from the largest U.S. oilfield as it shifted its focus to a clean energy transition. It said it would return $7 billion of the proceeds to shareholders on top of 20% to 30% of cashflow from operations. read more

“The remaining $5.5 billion of proceeds from the Permian divestment will be distributed in the form of share buybacks at pace,” it said.

Shell, which operates more than 45,000 petrol stations, said that earnings from its marketing division were set to be lower than the third quarter “the demand impact due to the Omicron virus and foreign exchange impacts in Turkey.”

Reporting by Ron Bousso; Editing by Jason Neely and Alexander Smith