Analysis: Weak winds worsened Europe’s power crunch; utilities need better storage

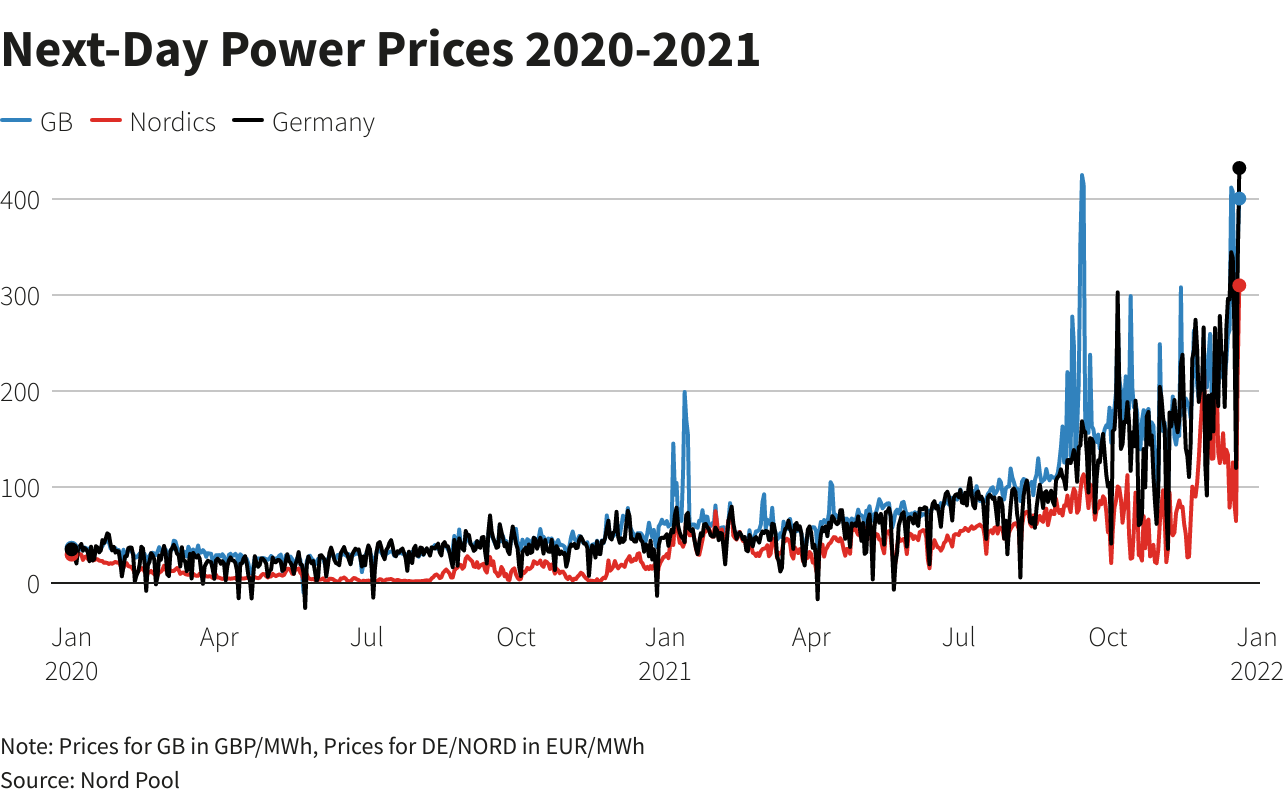

OSLO/COPENHAGEN, Dec 22 (Reuters) – Wind speeds were milder than usual in Europe this year, so windmills across the bloc generated less electricity which worsened a crunch that sent power prices to record highs as utilities had to buy more coal and scarce, costly, natural gas.

The situation illustrated a challenge facing the European Union as it tries to boost renewable power and meet its climate targets: Power prices can soar when the wind dies down, so generators need ways to store some of the excess power when winds are strong.

“If we had high winds or just reasonable winds over that period, we wouldn’t have seen these price spikes,” said Rory McCarthy, principal analyst at Wood Mackenzie.

Less wind power increased demand at thermal power plants, but tight natural gas supplies raised their costs. The worldwide spike in gas prices drove up energy bills for businesses and consumers. Some heavy industry had to cut supplies and some power suppliers went out of business. read more

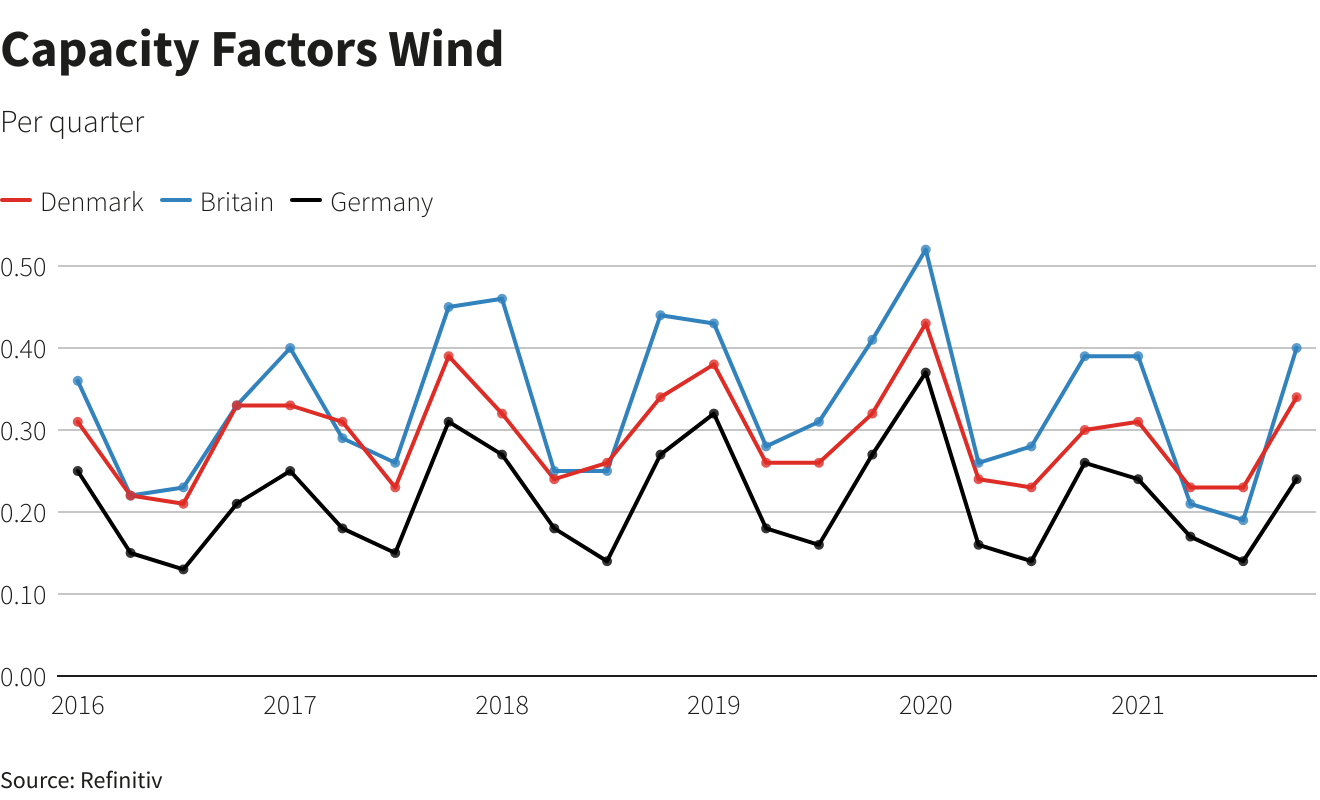

Europe’s largest wind producers Britain, Germany and Denmark harnessed just 14% of installed capacity, in the third quarter, when gas prices hit record highs, compared with an average of 20-26% seen in previous years, according to Refinitiv data.

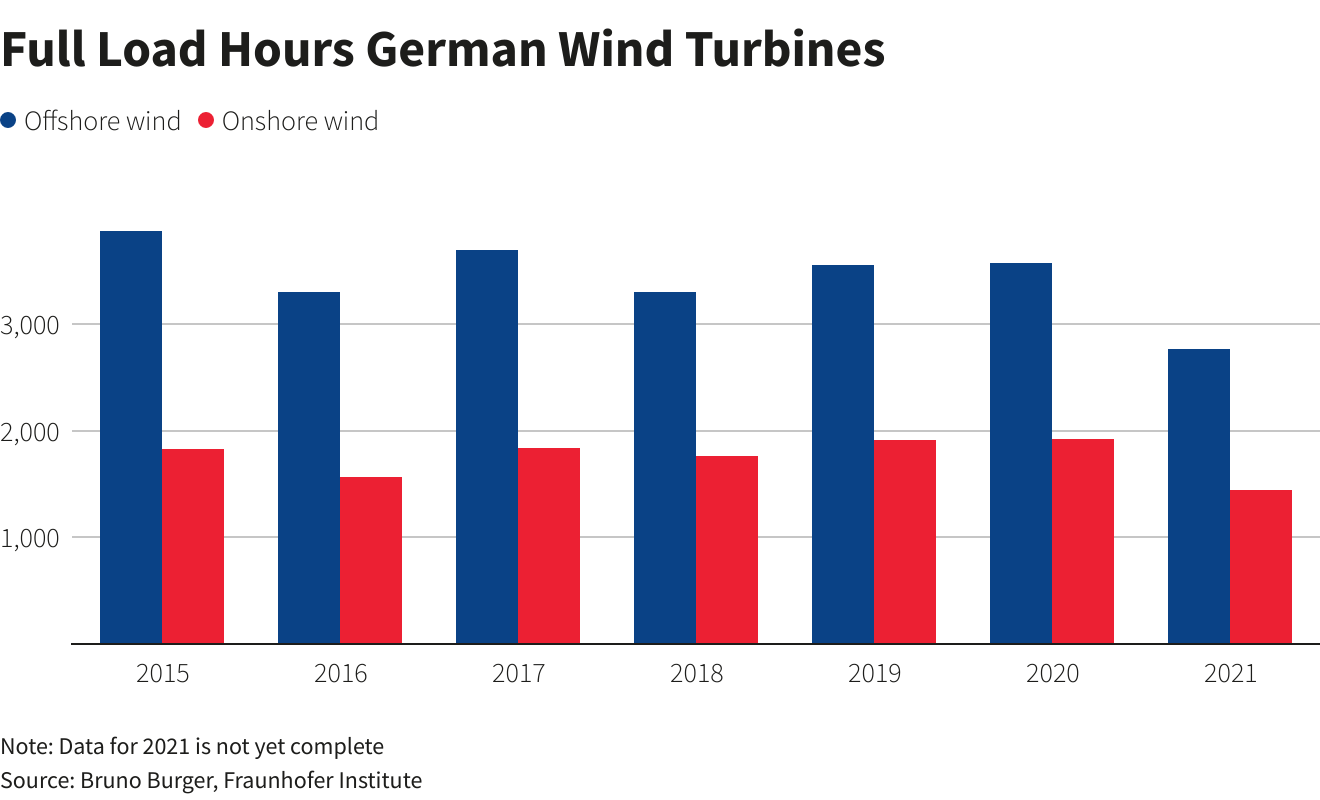

In Germany, Europe’s largest economy with the continent’s highest wind power capacity, combined output from both on and offshore wind farms fell around 16% this year-to-date, Bruno Burger, an analyst at Germany’s Fraunhofer Institute, told Reuters.

Wind power generation has low operating costs, offering cheaper wholesale power than thermal plants that must pay for fuel, along with costs associated with carbon emissions.

This makes wholesale electricity prices lower at times of high wind, leading to lower consumer bills. Weaker wind periods, which are not uncommon, cause prices to rise and more thermal plants are needed.

Anna Borg, chief executive of Swedish utility Vattenfall sees two lessons. First, “the market will be more volatile going forward and that the market needs to adapt to that,” she told Reuters.

Also, “there is an evident need and also a value in flexibility services and storage. … I think we are only at the beginning of the development of that kind of business model.”

Utilities across Europe are starting to invest in storage systems including large batteries or smart charging solutions for electric cars.

Several countries are also seeking to reward flexible consumer behaviour such as industrial customers curbing demand at certain hours. Better matching supply and demand can help maintain grid stability.

Europe currently invests 40 billion euros a year on power grids, according to lobby group WindEurope which estimates that annual investments need to double over the next thirty years to 66-80 billion euros a year.

BUILD MORE

Both the European Commission and International Energy Agency (IEA) said recent record energy prices should not slow the effort to meet climate targets under the Paris agreement by moving away from fossil fuels. read more

Instead, governments should help boost capacity of wind and other renewable power sources, ensuring more overall output and avoiding the need for reliance on fossil fuels as backup.

“The more renewable energy we can build, the more electricity will come from those sources and the less coal and gas is needed for electricity production,” Christian Rynning-Toennesen, head of Norwegian utility Statkraft, told Reuters.

“So we think the trend (for renewable energy growth) will continue and be strengthened by these electricity prices, rather than slowed down,” he said.

But some believe the energy transition may already be getting ahead of itself. Sindre Knutsson, vice president markets at consultancy Rystad Energy told Reuters Europe is turning away from fossil fuels too quickly.

Knutsson noted that more coal-fired plants capable of stable power generation are being decommissioned together with nuclear.

“It’s no secret that we will use renewables to generate electricity in the future. But at the moment, we’re still relying on fossil fuels,” he said.

Low or zero-emissions back-up capacity for periods of low wind or solar supply such as batteries, hydrogen or carbon capture and storage are still more than a decade away from being available at scale, agreed Matthew Jones, lead analyst for EU Power at ICIS.

“So for the moment thermal capacity is required,” he told Reuters. EARNINGS HIT

Earnings at several European wind power generators were hit by this year’s wind lulls, but the companies remain committed to increasing capacity.

The world’s biggest developer of offshore wind farms, Orsted (ORSTED.CO) said the lower wind speeds had a negative 2.5 billion crowns ($379.20 million) impact for the first nine months of the year compared to 2020.

Germany’s RWE (RWEG.DE) said weaker winds caused profits at its wind and solar units to fall by 38% in the first nine months of the year.

There was nothing to suggest that climate change itself played a role in the lower wind speeds, companies in the sector said.

“We follow it on a daily basis, but we see nothing which indicate that there is a long-term change coming,” Orsted’s head of Continental Europe, Rasmus Errboe, told Reuters.

Statkraft also regularly measures wind speeds and conditions but had not seen any extraordinary adjustments to its data, according to its CEO.

“To my knowledge, there’s not any pattern that we can see,” Rynning-Toennesen said.

VOLATILITY

More renewables will make prices more volatile in the short to mid term, as weather will largely dictate prices, the heads of two power trading firms agreed.

“It will become common for the electricity market in Europe to have a very high degree of volatility because that will just be the nature of the assets that we are bringing online and the nature of the assets that we are taking offline,” said chief executive at trading firm InCommodities, Jesper Johanson.

Power traders, who typically profit from gyrating conditions, say the market can handle the higher volatility, and price spikes provide investors with an incentive to fund back-up solutions.

“In order to get commercial investments going into different kind of storage, like batteries, the market needs to give that price signal. There needs to be volatility and the stronger that price signal is, the more investments we will see,” Johanson added.

High prices should favour construction of more renewable energy, agreed Anders Bauditz, chief executive of trading firm Norlys Energy Trading.

“Hopefully, the politicians have seen these price extremes over the last few months and will do the tally and then realize that probably we need to push for even more green energy and then figure out how we solve the problem with the intermittency,” he told Reuters.