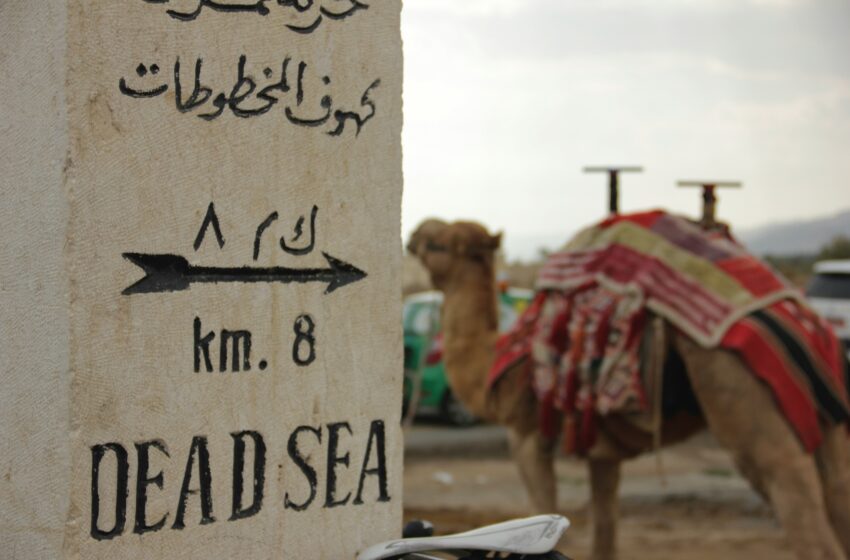

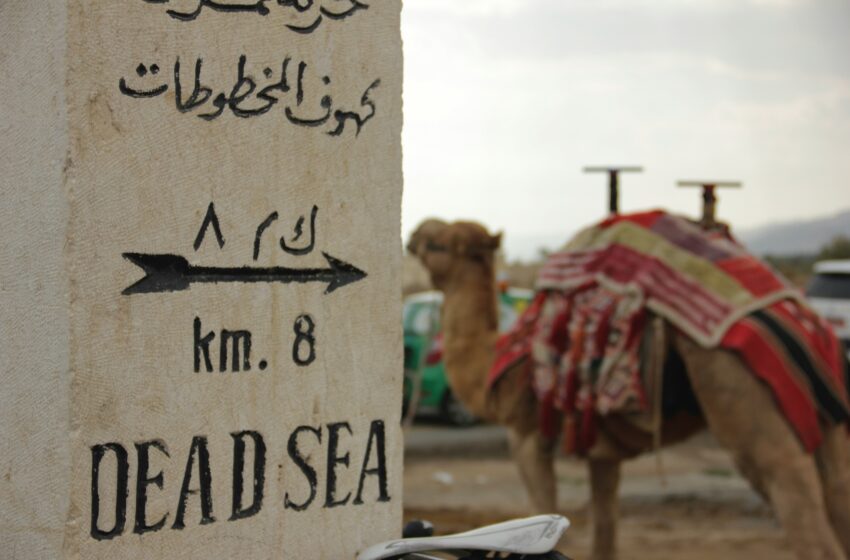

Desert Gold: Inside the Real Estate Boom Shaping the New Middle East

Luxury high-rises and sprawling smart cities. Industrial hubs fueling global trade. A wave of fresh visas and expat influx driving demand like never before. The Middle East’s property market is no longer just a regional story—it’s a global phenomenon capturing investor attention worldwide. As governments push mega projects and embrace innovation, these cities are evolving into magnets for wealth, talent, and opportunity. But with rapid growth comes complexity—balancing soaring prices, shifting buyer profiles, and geopolitical factors. What’s behind this surge? And what does the future hold for a region rewriting the rules of real estate investment?

The Middle East’s real estate market has transformed dramatically over the last decade. Once seen as a region prone to speculative bubbles and incomplete projects, it is now a beacon of sustained growth, innovation, and global investor confidence. Dubai, Riyadh, and Abu Dhabi are no longer just regional hubs—they are vying for a place among the world’s top-tier real estate markets.

In 2023, Dubai recorded an astonishing AED 528 billion ($143.7 billion) in property transactions, a 37% increase compared to the previous year, according to CBRE. Off-plan sales surged by nearly 90%, revealing robust investor trust in developments still under construction. At the same time, Saudi Arabia’s ambitious Vision 2030 blueprint has triggered plans to pour more than $1 trillion into real estate and infrastructure projects over the next decade. This wave of investment isn’t a passing tide—it’s reshaping urban life across the Gulf.

Urban Renaissance: Beyond Towers and Skylines

The narrative around Middle Eastern real estate is evolving. The focus is shifting from mere luxury and spectacle to sustainable, citizen-focused development. Riyadh exemplifies this change. Mega-projects like Diriyah Gate and King Salman Park emphasize walkability, cultural integration, and environmental sustainability.

“We’re building cities for citizens, not just tourists,” explains Dr. Abdullah Alghamdi, real estate economist at King Saud University. This sentiment reflects a broader trend of creating livable, human-centric urban spaces rather than just iconic structures.

Dubai’s comeback story rides on multiple forces—zero personal income tax, flexible visa schemes, and the growing remote-work culture. Foreign investors accounted for 40% of Dubai’s property purchases in 2023, with notable demand from India, Russia, and China. The market for luxury residences is booming; the sale of a penthouse at Bulgari Lighthouse for AED 410 million ($111 million) set a new UAE record and signals growing appetite for ultra-premium properties.

The People Factor: Migration, Residency, and Long-Term Demand

At the heart of the real estate surge is the human element. The Gulf’s governments have introduced reforms like the 10-year Golden Visa and the Digital Nomad Visa, encouraging skilled professionals and entrepreneurs to settle longer-term. Owning property has become not just a lifestyle choice but a pathway to residency and permanence.

A 2024 report by JLL MENA found that 60% of Dubai’s renters plan to buy property within the next two years, signaling a paradigm shift in a market historically characterized by transient expat populations. This demand extends beyond high-net-worth buyers; thousands of remote workers and digital nomads are now investing in apartments in vibrant neighborhoods like Business Bay and Dubai Marina.

The Quiet Rise of Industrial Real Estate

Luxury and residential developments often steal the spotlight, but the industrial and logistics sectors are quietly flourishing. With the Gulf’s strategic position as a trade nexus between Asia, Europe, and Africa, free zones like JAFZA (Dubai), KIZAD (Abu Dhabi), and King Abdullah Economic City (Saudi Arabia) are booming.

The explosion of e-commerce has propelled demand for warehouses, distribution centers, and last-mile logistics hubs. Industrial property yields in the UAE now average 6–7%, often outperforming traditional residential returns. This diversification adds resilience to the region’s property market, making it attractive to a wider range of investors.

Key Property Investment Zones to Watch

- Dubai Marina & Palm Jumeirah (UAE): Iconic luxury waterfront living and perennial favorites for global investors.

- Business Bay (Dubai): Dynamic commercial and residential district, ideal for professionals and remote workers.

- Saadiyat Island (Abu Dhabi): A cultural and residential enclave witnessing double-digit price growth.

- Diriyah & Roshn (Riyadh, Saudi Arabia): Emerging lifestyle and mixed-use developments supported by government initiatives.

- King Abdullah Economic City (Saudi Arabia): Strategic industrial and residential zone with long-term growth prospects.

- NEOM (Saudi Arabia): A futuristic, $500 billion smart city project promising revolutionary urban living.

Managing Risks in a Fast-Moving Market

Of course, no boom is without risks. Global interest rates have risen, potentially cooling demand in some luxury segments. Oversupply in certain areas is a concern, as developers rush to meet growing appetite.

Yet, many experts see the Middle East as offering something rare in today’s uncertain world: political stability, visionary government strategies, and tax advantages. A Dubai-based real estate analyst summed it up this way:

“Crypto investors faced losses in 2022 and 2023, but those who bought property in Dubai often saw their investment double. That kind of resilience speaks volumes.”

Conclusion: A New Frontier in Real Estate

The Middle East’s real estate boom is more than a regional phenomenon; it’s a global story of transformation. It reflects the region’s drive to diversify economies, attract talent, and build cities that can compete with the world’s greatest urban centers. From luxury penthouses and waterfront villas to industrial logistics hubs and visionary smart cities, the Gulf is shaping the future of property investment.

With cranes and construction projects visible across skylines, the message is clear: the desert is no longer just a backdrop—it’s the center stage for one of the most compelling real estate markets in the world.

Sources:

CBRE MENA Market Outlook 2024

Knight Frank Wealth Report 2024

JLL Middle East Residential Tracker

Gulf Business Real Estate Rankings

UAE & KSA Government Announcements

Bloomberg Middle East Property Reports

Reuters: “UAE Luxury Real Estate Sets Records”

Arabian Business & Al Arabiya Interviews