Verdant Capital establishes connections with microfinance leads on the African Investments Dashboard

Verdant Capital, a leading investment bank and investment manager operating on a Pan-African basis and specialising in private capital markets, is welcomed back as a loyal sponsor for AFSIC – Investing in Africa 2025. Verdant Capital boasts offices in Johannesburg, Ebene, Accra, Harare, Kinshasa and Frankfurt with transactions executed in more than 25 African countries. We interviewed Verdant Capital on their experience using our African Investments Dashboard and asked for their insights into the macro investment landscape in Africa as successful pan-African investor.

What is your experience as an investor on using the African Investments Dashboard? Can you elaborate on the connections made and the quality of deals on the platform? Excellent experience from the perspective of microfinance, as a Pan-African investor engaging with microfinance institutions. We have established connections with several microfinance leads with whom we are presently advancing funding discussions.

What are you seeing in the investment landscape into Africa from a macro perspective? In general, the investment environment in Africa offers prospects for growth and development, propelled by demographic shifts, technological progress, and investments in infrastructure. However, it is essential to tackle challenges such as debt management, currency fluctuations, and climate-related risks to ensure sustained growth. From the viewpoint of microfinance, we have explored substantial opportunities in East Africa – specifically in Kenya, Uganda, and Tanzania, as well as in West Africa – particularly in Nigeria and Ghana, and in Southern Africa – notably in Zambia and South Africa. Numerous countries, including Nigeria, Ghana, Zimbabwe, Botswana, Kenya, and Egypt, have encountered considerable macroeconomic challenges.

How has Verdant successfully navigated the investment landscape? We possess a diversified exposure to various markets concerning the investments we have made thus far. We have identified substantial growth prospects in the microfinance sector, particularly in SME lending, due to the significant credit gap and demand; this remains a top priority for us and constitutes the majority of our completed investments to date. Considering the country risk associated with numerous African nations, our investments are supported by credit enhancements such as corporate guarantees, which not only bolster investor confidence but also aid in risk mitigation, thereby enhancing the credibility of our investments. Furthermore, we mandate our investees to hedge against foreign exchange risk, given the potential for currency volatility in African countries.

About AFSIC – Investing in Africa:

AFSIC – Investing in Africa has become perhaps Africa’s most important annual investment event. AFSIC is wholly focused on accelerating Africa’s economic emergence by matching investment opportunities in Africa transforming Africa’s business, trade and investment environment, sustainably growing Africa’s economy at a continental scale.

About African Investments Limited:

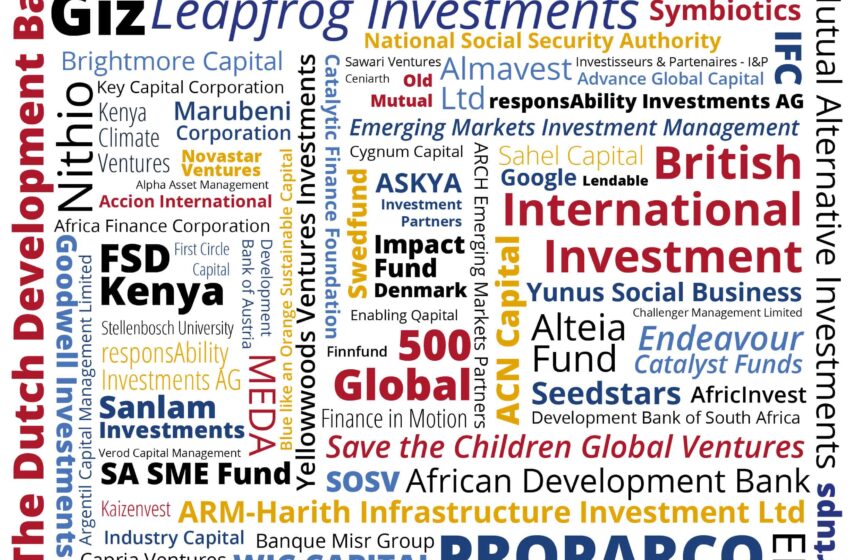

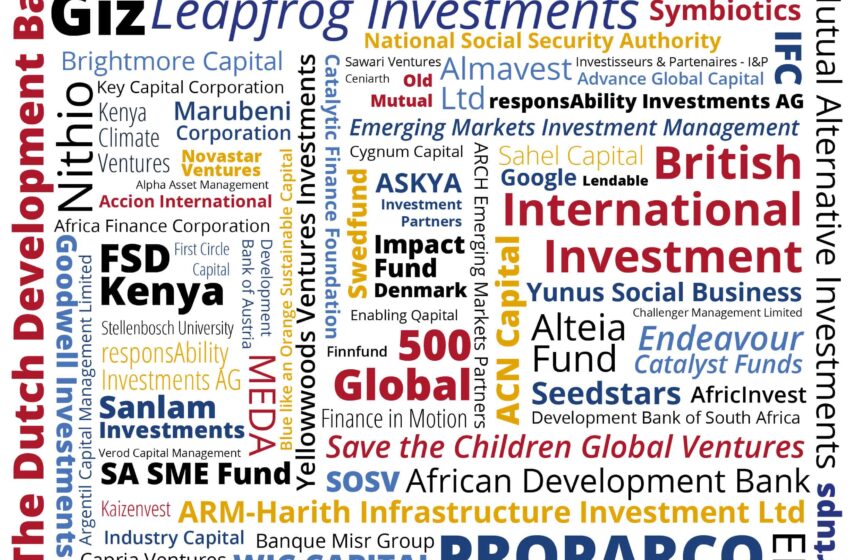

African Investments Limited, operates two multi award-winning digital platforms, the African Investments Dashboard (www.africaninvestments.ai), connecting global investors with curated, high-quality investment opportunities across Africa, and the Africa Business Opportunities Dashboard (www.businessopportunities.ai), which matches business, trade and investment opportunities across Africa covering all business objectives, products, sectors and countries in Africa.

Resources:

www.afsic.net

www.africaninvestments.co

www.africaninvestments.ai

www.businessopportunities.ai