Three steps to stop the health crisis turning into the biggest emerging market debt crisis

The servicing and rolling over of the public and private debt of middle-income countries is a major point of COVID-19-induced stress in the global economy. The G20’s Debt Service Suspension Initiative is a worthy initiative, but it does not address this issue. This column outlines three related steps that may help avoid a crisis. The centre-piece is recycling new and unused Special Drawing Rights for debt reduction through the repayment or repurchase of debt. Moral hazard can be addressed by reducing only those debts held by official creditors and up to an amount equal to fiscal expenditures relating to natural disasters – COVID-19 and climate change, principal amongst them.

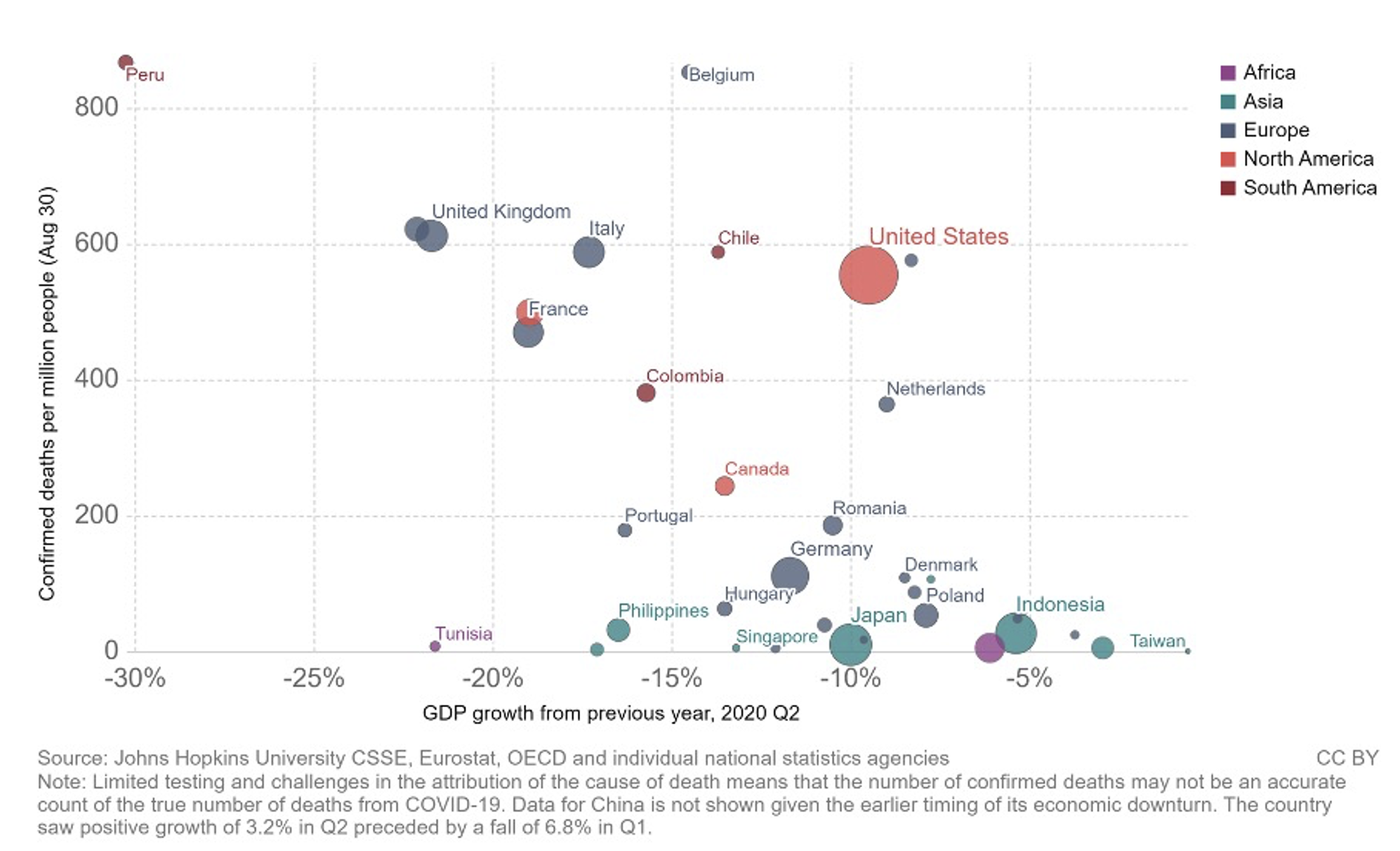

There is no discernible trade-off between health and GDP outcomes in 2020 (Figure 1). That’s one unenviable choice governments were saved from having to make. The economic impact of COVID-19 was highly differentiated, it was not just driven inversely to health outcomes. Early GDP estimates suggest that except for a few fragile states, factors driving GDP in 2020 were the degree to which countries were hit by the global cessation of trade, travel, foreign direct investment, and the degree to which they had the policy space to offset a widespread economic shutdown (Arezki et al. 2021).

Figure 1 Economic decline in the second quarter of 2020 vs rate of confirmed deaths

Tourism arrivals fell by 70-75% in 2020, compared with a decline of 8% during the Global Crisis (UNWTO 2020). The global economy contracted by around 4%, but the shock in tourism-dependent places was far greater. In Aruba, Fiji, and the Maldives, GDP collapsed by 20% (Table 1). Elsewhere, the central banks of large economies responded with collective purchases of almost $8 trillion of government bonds (WSJ 2020).1 This quantitative easing was more than double that during the height of the Global Crisis. Easy money and negative interest rates provided the backdrop for massive fiscal stimulus. The combined fiscal and monetary stimulus has been around 20% in developed countries according to the IMF, but only 6% in middle-income countries (WEO 2020).

Table 1 Twenty countries with the largest declines in GDP in 2020

Source: IMF WEO, January 2021 Update

The countries without policy space whose economies are dependent on trade, travel, and FDI are not the largest. Large countries rely more on internal markets. The most ‘COVID-sensitive’ states are not the poorest either. Low-income countries are generally short of trade, tourism, and FDI. Only one ‘IDA-only’ country, the Kyrgyzstan Republic, makes it into the top twenty ‘losers’ of 2020 – and only just. IDA-only countries are those with a gross national income per capita of less than $1,185. Along with 15 small ‘blend’ countries with limited market access like St. Lucia and Belize, they are eligible for the Debt Service Suspension Initiative (DSSI), the centre-piece of the international community’s response to COVID-19 so far. Collectively, the DSSI suspends potentially $12 billion of payments to official lenders, or individually, less than 1.0% of the GDP for more than 80% of DSSI-eligible countries.2 While some would argue that at least the DSSI targets the poor, we must distinguish between poor people and poor countries. Seventy percent of the world’s poor live in middle- and upper-middle-income countries (Kanpur and Sumner 2011). And today, many of those countries are too strapped to provide adequate protection to their poorest citizens. Unless we act now, a great number of people will fall into poverty, with the greatest number probably living in middle-income COVID-19-sensitive states.

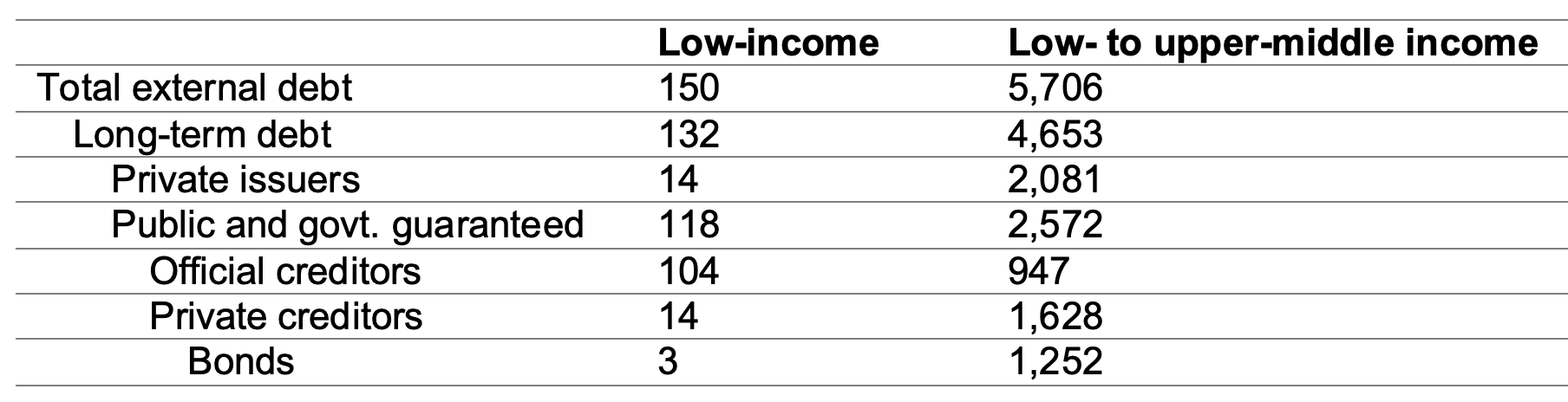

Middle-income countries owe most of their debt to private creditors. Private creditors, like emerging market bond funds, own just 9% of the external public debt of low-income countries, but 63% of that of middle-income countries (Bolton et al. 2020). Critically, private creditors also purchased a further $2trn of corporate debt in middle-income countries (Forni and Turner 2021).

Table 2 Debt, by country groups, type of debt and by creditors in April 2020 ($ billion)

Source: World Bank data reproduced from Bolton et al. (2020).

Debt rose everywhere in 2020, but a critical consideration for locating the stress point is the changing conditions for servicing and rolling over existing debt. Because of the difference in fiscal and monetary constraints for low- and middle-income countries, 90% of the $12 trillion increase in government debt in 2020 was in developed countries (IIF 2021). The main problem facing middle-income countries was that they were constrained from borrowing what they needed to borrow due to stretched debt levels, collapsing revenues, eligibility criteria for official lending, and high GNI per capita levels. The constraint came partly in the form of fleeing investors and falling credit ratings. In March 2020, international investors sold over $83bn of emerging market equity and bonds – the biggest monthly reversal on record (IIF 2020). Their currencies slumped against the dollar, increasing dollar-denominated debt as a percentage of GDP, and their bond prices declined almost 20% in a few weeks (Hevia and Neumeyer 2020). Moreover, credit rating agencies followed the sell-off with the largest number of downgrades since before the Global Crisis (Financial Times 2020), further tightening the borrowing constraint. At that point, and for domestic reasons, the US Federal Reserve stepped up its quantitative easing. Quantitative easing, alongside high uncertainty over the path of COVID-19 and the economy, sent the US dollar down 14% against a basket of major currencies during the rest of 2020, and emerging market bond prices recovered (Dedola et al. 2020, Bruno and Shin 2020).

But as US fiscal stimulus and vaccinations drag the economy into a strong recovery in 2021, March 2020 is likely to give us a measure of the risks we face. One further dynamic is roll-over risk. Developing country governments, excluding those eligible for DSSI, have to refinance $659 billion of government, dollar-denominated debt coming due in 2021 and 2022, or 25% of the outstanding stock. Additionally, private firms in developing countries have to refinance $400 billion, or 20%, of their dollar debt (Bolton et al. 2020).

History’s lesson is that a large supply of bonds to be financed or rolled over is less of a problem when there is little contest for savings because the economy is weak, or when a falling dollar makes dollar bonds easier to finance. But when debts are high, the global economy is recovering and the dollar is strengthening, past precedents are disturbing. It was a rising US dollar, a gathering US recovery and growing US deficits following the Economic Recovery Tax Act of 1981 that triggered the Latin American debt crisis on 12 August 1982, heralding Latin America’s lost decade.

The last major emerging market crisis, the Asian Financial Crisis of 1997, not only had a huge and long-lasting impact in Asia but its effects reverberated around the world. Back then, emerging market bonds were just 2% of the global bond market. Today they are 25% (BIS 2019). An emerging market debt crisis will likely have a profound global impact, derailing the best laid COVID-recovery plans.

To prevent the health crisis from turning into a financial crisis, we need a policy response geared towards middle-income and low-income countries to achieve debt reduction, find new resources and recognise private creditors as well as official ones. The following three steps provide a roadmap:

1. Recycle half of new and unused Special Drawing Rights (SDRs) to buy back debt, avoiding moral hazard by limiting the buy-backs to debt held by official creditors and only by an amount equal to expenditures from natural disasters like climate change or COVID-19.

On 26 July 2020, IMF managing director Kristalina Georgieva said “…our message to governments is clear: spend whatever it takes, but make sure you keep the receipts…”. If the new SDR allocation exceeds $500 billion, as is likely, it could have a considerable impact on developing country debt reduction, without resources having to travel ‘uphill’. $500 billion is more than 30% of developing country debt held by private creditors or 35% of debt held by the official sector. The leading objection to this is moral hazard. Wouldn’t this remove fiscal discipline, encourage excessive borrowing and lending, and enable unsustainable debt to persist to the benefit of greedy bondholders? Not if we removed those debts built up as a result of external factors that countries had no control over, and the debts bought back were those of official creditors. What would be left would be even more related to domestic policy choices.

Governments have the receipts for the fiscal costs of COVID and the fiscal costs of climate-change related disasters. A significant amount of the debts of countries on the front line of climate change – between the tropics of Cancer and Capricorn where rising temperatures and sea levels are most extreme, can be traced directly to the fiscal costs of a climate change related natural disaster, like more frequent category five hurricanes in the Caribbean and Pacific and devastating droughts in Africa and Asia (Noy 2012, King 2014).

2. Recycle half of new and used SDRs to recapitalise development banks to lend more to the private sector to support a green recovery.

We need additional resources as well as debt reduction. We propose recycling new and unused SDRs to recapitalise development banks for the purpose of supporting a green, resilient, and inclusive recovery. The current resources available to the regional development banks are not sized for an economy-stopping pandemic. Because of overburdened public sector balance sheets this lending should be focused on the private sector, either through public private partnerships or incentives that crowd-in private investment.

Speed is an issue; countries that suffered double digit declines in GDP and employment overnight need fast-disbursing, long-term budget support not lengthy processes that call on hard-pressed officials to spend weeks designing ‘conditionality’, however home-grown. The staff and their boards must commit to the rapid disbursements of disaster response funding.

3. Barbadian-style natural disaster clauses in all debt instruments

In the natural disaster clauses written into all Barbadian domestic and international bonds, once a natural disaster has been independently verified, there is an immediate suspension of debt service for two years with the maturity of the loan increased by two years. This frees up 7% of GDP in Barbados. If all official debt had natural disaster clauses which included pandemics, $100 billion of resources would have been freed up in 2020 and a similar amount in 2021, compared with the $5 billion released by the DSSI so far. This is more attuned to the scale and speed this moment calls for. By adopting these clauses, the official sector will drive general adoption of these clauses that could have freed up a further $262 billion of cash flows this year, severely blunting the crisis. There has been no sign that Barbadian bonds have suffered a yield penalty for having these clauses, with indications of perhaps the opposite.3 Automatically shifting cash flows to when a borrower is better able to pay improves credit quality.

The portents are not good if we want to avoid the health crisis turning into the largest emerging market debt crisis with global impact. A major point of stress is the servicing and roll-over of the public and private debt of middle-income countries. The G20’s Debt Service Suspension Initiative is a worthy initiative but it does not address this. The coming crisis can be avoided if three related steps are taken. The centre-piece is recycling new and unused SDRs for debt-reduction through the repayment or repurchase of debt. Moral hazard can be addressed by reducing only those debts held by official creditors and up to an amount equal to fiscal expenditures relating to natural disasters – COVID-19 and climate change principal amongst them.

References

Arezki, R, S Djankov and U Panizza (2021), “Shaping Africa’s post-Covid recovery: A new eBook”, VoxEU.org, 23 February.

Bird (2021), “How the 2020 QE Boom Might Trip Up Central Bankers”, The Wall Street Journal, 29 December.

Bolton P, L Buchheit, P-O Gourinchas, M Gulati, C-T Hsieh, U Panizza and B Weder di Mauro (2020a), “Born Out of Necessity: A Debt Standstill for COVID-19”, CEPR Policy Insight no 103.

Bruno, V and H S Shin (2020), “Currency depreciations and emerging market corporate distress”, Management Science 66(5).

Dedola, L, G Georgiadis, J Gräb and A Mehl (2020), “Quantitative easing policies and exchange rates”, VoxEU.org, 21 October.

Forni, L, P Turner (2021), “Global liquidity and dollar debts of emerging market corporates”, VoxEU.org, 15 January.

Hevia, C and A Neumeyer (2020), “Perfect storm, Covid, emerging markets”, VoxEU.org, 21 April

IIF (2020), “Capital flow tracker”, April.

IIF (2021), “Global Debt Monitor”, February.

Kanpur, R, A Sumner (2011), “Poor countries or poor people? The new geography of global poverty”, VoxEU.org, 8 November.

King, D (2014), “Causes of debt accumulation in SIDS”, in D Tennant and D King (eds), Debt and Development, Chapter 7, Palgrave Macmillan.

Noy, I (2012), “The enduring economic aftermath of natural catastrophes”, VoxEU.org, 5 September.

Temple-West, P (2020), “Rating agencies brace for backlash after rash of downgrades”, FT.com, 3 April.

UNWTO (2020), “Tourism back to 1990 levels as arrivals fall by more than 70%”.

Endnotes

1 The Wall Street Journal reports that the Federal Reserve, European Central Bank, Bank of Japan and the Bank of England, expanded their balance sheets by $8bn in 2020. Other central banks have also been engaged in forms of QE, such as China and Russia and so the global figure is likely north of this.

2 Author’s calculations based on data from the IMF WEO, October 2020 and IMF Fiscal Monitor April 2020

3 Barbadian bonds currently trade at a modest premium to bonds with a similar credit rating

Source: https://voxeu.org/article/three-steps-stop-health-crisis-turning-biggest-emerging-market-debt-crisis