Marketmind: When the Dragon sneezes, Europe catches a cold

Sept 16 – A look at the day ahead from Danilo Masoni.

As pressure builds on China’s tech and real estate moguls and its economic growth falters, markets worldwide are starting to get uneasy. But it’s Europe, with its export-oriented economy and supercharged luxury stocks reliant on affluent Asian shoppers, which is likely to feel the most genuine pain.

The STOXX 600 index (.STOXX) has fallen 1% so far in September, twice as much world stocks (.MIWO00000PUS), and while Europe broadly is still in favour with investors and research analysts, the index has slipped all the way down to July lows.

Wall Street’s strength overnight could trigger a relief bounce this morning, but the China woes are far from over.

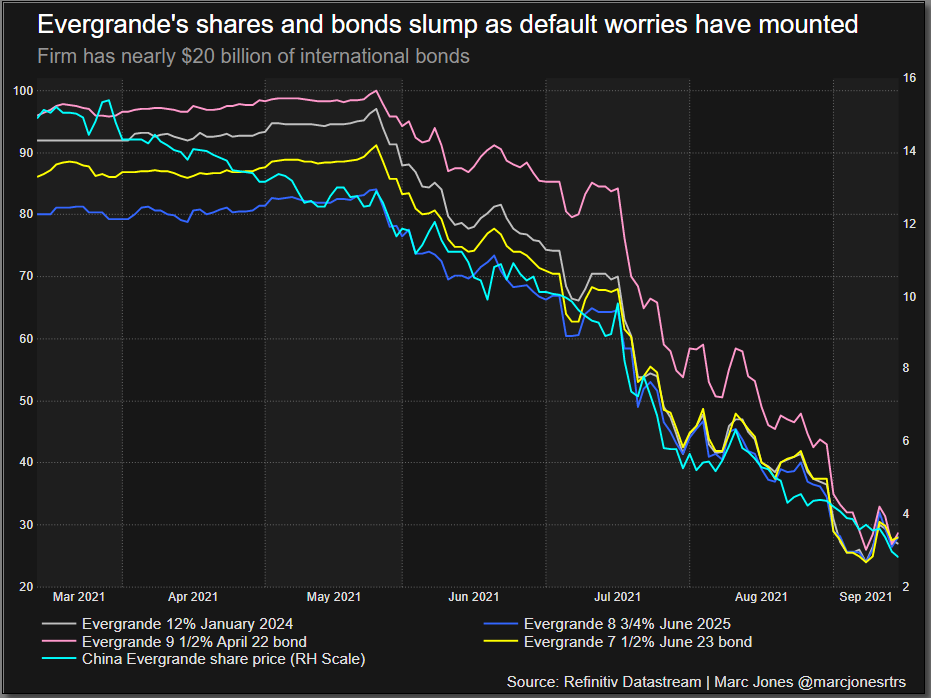

The worsening crisis at China’s No. 2 property developer Evergrande has sent its shares to decade lows, pushed Asian stock markets to their fourth day of losses. Trading in Evergrande bonds has been suspended. And virus outbreaks are clouding travel plans during next week’s Mid-Autumn Festival.

Europe Inc faces internal woes too. Soaring power prices have prompted Spain to cap energy bills and Italy said on Thursday it plans “short-term measures” to offset the price rises. Worries are other governments could resort to similar measures — at the expense of utility firms.

There’s some market support from signs U.S. inflation has peaked and the world’s biggest economy is in robust shape. Retail sales will be eyed later on for more clues on the health of the world’s largest economy.

Key developments that should provide more direction to markets on Thursday:

Japan’s hot exports growth cools as COVID-19 hits supply chains read more

Philip Morris seals deal to buy UK’s Vectura with 75% stake tendered read more ; French utility Veolia launches 2.5 bln euro capital increase[nL1N2QI0D1; Vivendi paves way for Lagardere takeover

German car registrations Aug

ECB Speakers: Christine Lagarde

Norges Bank Governor Oystein Olsen speaks

Egypt central bank meeting

U.S. weekly jobless claims/Philly Fed September

U.S. Retail sales/business inventoriesReporting by Danilo Masoni; editing by Sujata Rao

Our Standards: The Thomson Reuters Trust Principles.

Source: https://www.reuters.com/business/morning-bid-when-dragon-sneezes-europe-catches-cold-2021-09-16/