Marketmind: Gathering Clouds?

A look at the day ahead from Saikat Chatterjee.

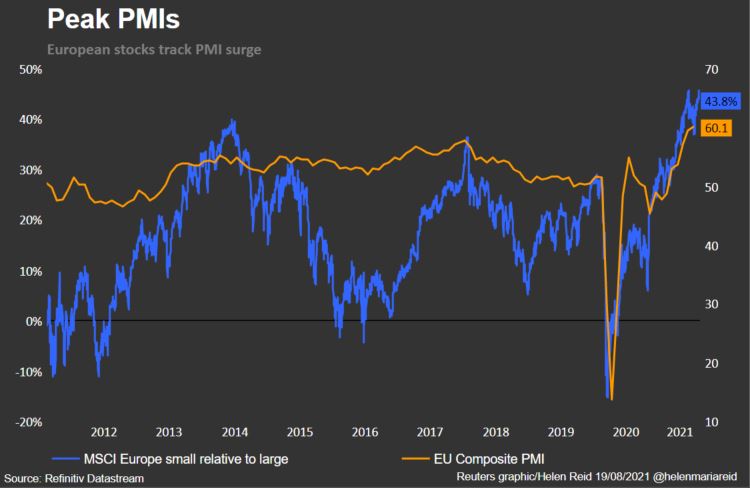

European stocks posted their biggest weekly drop last week since February. A large part of the reason behind the sharp drop is growing concerns over a slowing global economy, as well as increasing fears over rising infection rates and vaccine durability. Investors hoping for a bounce this week from a clutch of “flash” European manufacturing surveys for August out on Monday may be disappointed going by the recent softening trend in U.S. and Chinese PMIs.

The broad message from the European PMI camp is likely that the strong recovery in growth seen over Q2 is now in danger of fading as a combination of rising prices, ongoing supply chain issues (see Toyota news last week read more ) and labour shortages take their toll on business activity.

Indeed, investors in an August global fund manager survey by investment bank BoFA Securities cut their expectations for global growth to their lowest since April 2020. Notwithstanding a wave of short covering lifting Asian markets in early Monday, signs of growing caution are rife in asset markets.

Base metals, bulk resources and oil are struggling after global growth jitters took a heavy toll on commodities last week. The dollar index consolidated gains below a November 2020 high while the yield curve held near a one-year low.

The focus will shift to the Fed later in the week when Fed Chair Jerome Powell takes the stage at the Jackson Hole symposium. Markets will be keenly watching the tapering plan and potential next steps from officials.

While much of the tapering news value is already baked into markets, it remains to be seen whether the global rise of the Delta variant prompts the Fed to soften its rhetoric.

Elsewhere, in coronavirus news, Prime Minister Jacinda Ardern on Monday extended New Zealand’s strict nationwide COVID-19 lockdown.

Key developments that should provide more direction to markets on Monday:

Germany, France, UK, Euro PMIs

U.S. home sales

Private equity companies are circling British supermarket group Sainsbury’s SBRY.L with a view to possibly launching bids of more than 7 billion pounds ($9.53 billion), the Sunday Times reported. read more

Reporting by Saikat Chatterjee

Our Standards: The Thomson Reuters Trust Principles.

Source: https://www.reuters.com/business/morning-bid-gathering-clouds-2021-08-23/